Applied Sciences | Free Full-Text | Portfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading

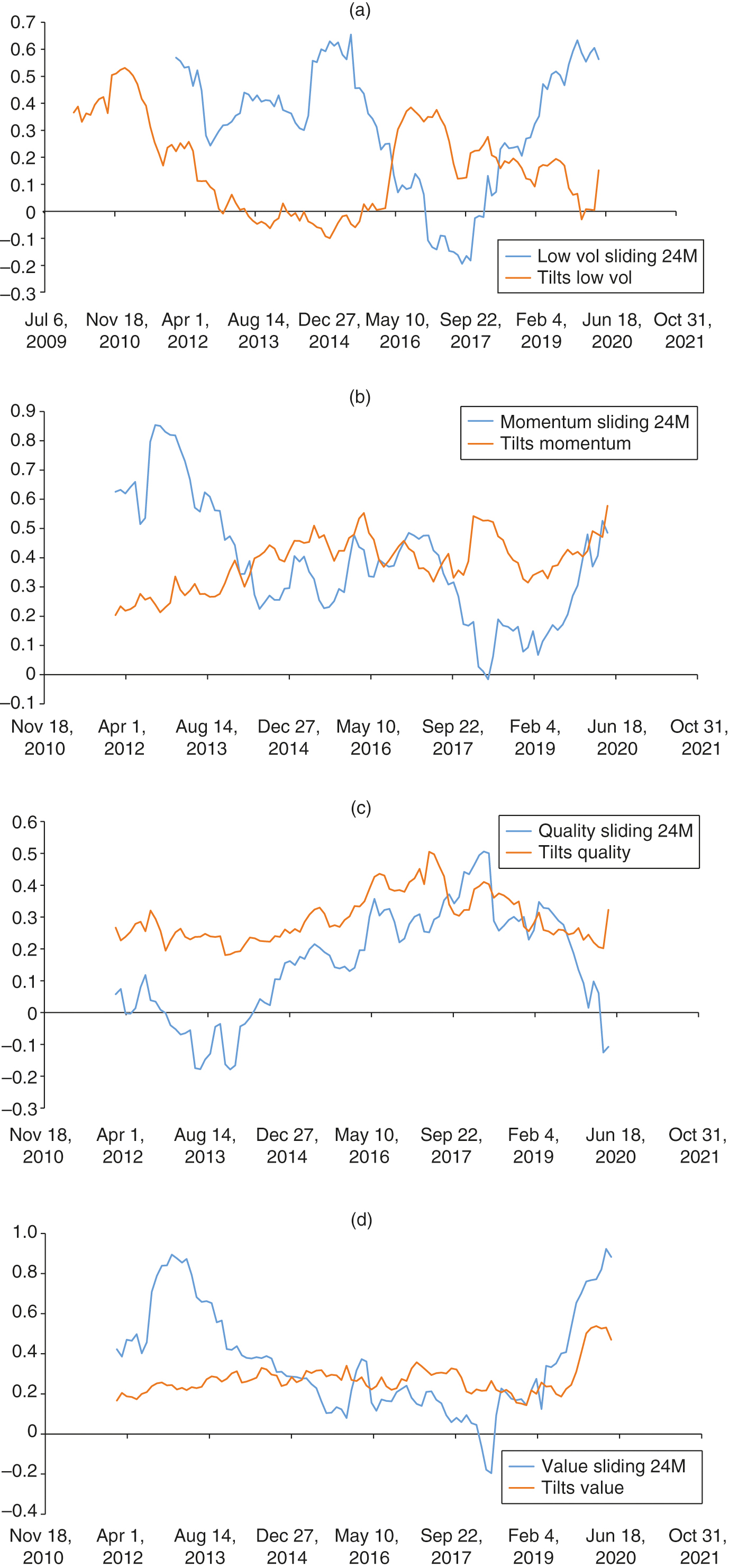

Fundamental Factor Long/Short Strategy with Mean Variance Portfolio Optimization by Jing Wu - QuantConnect.com

Long/short portfolio optimization for the market crash of late 2018, Sharpe ratio 1.82, Return 35.4%

![PDF] Portfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading | Semantic Scholar PDF] Portfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/54ae9d8e95ae8be88e4bff9c891a1a1e3978553e/11-Table1-1.png)

PDF] Portfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading | Semantic Scholar

Applied Sciences | Free Full-Text | Portfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading

Figure A1. This figure illustrates a graphical flowchart that shows a... | Download Scientific Diagram

Long/short portfolio optimization for the market crash of late 2018, Sharpe ratio 1.82, Return 35.4%

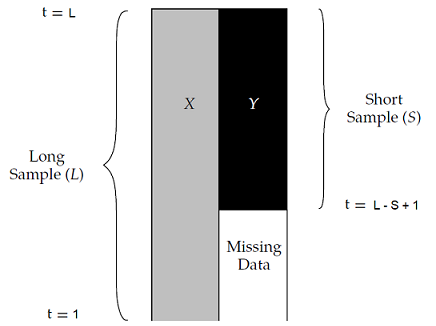

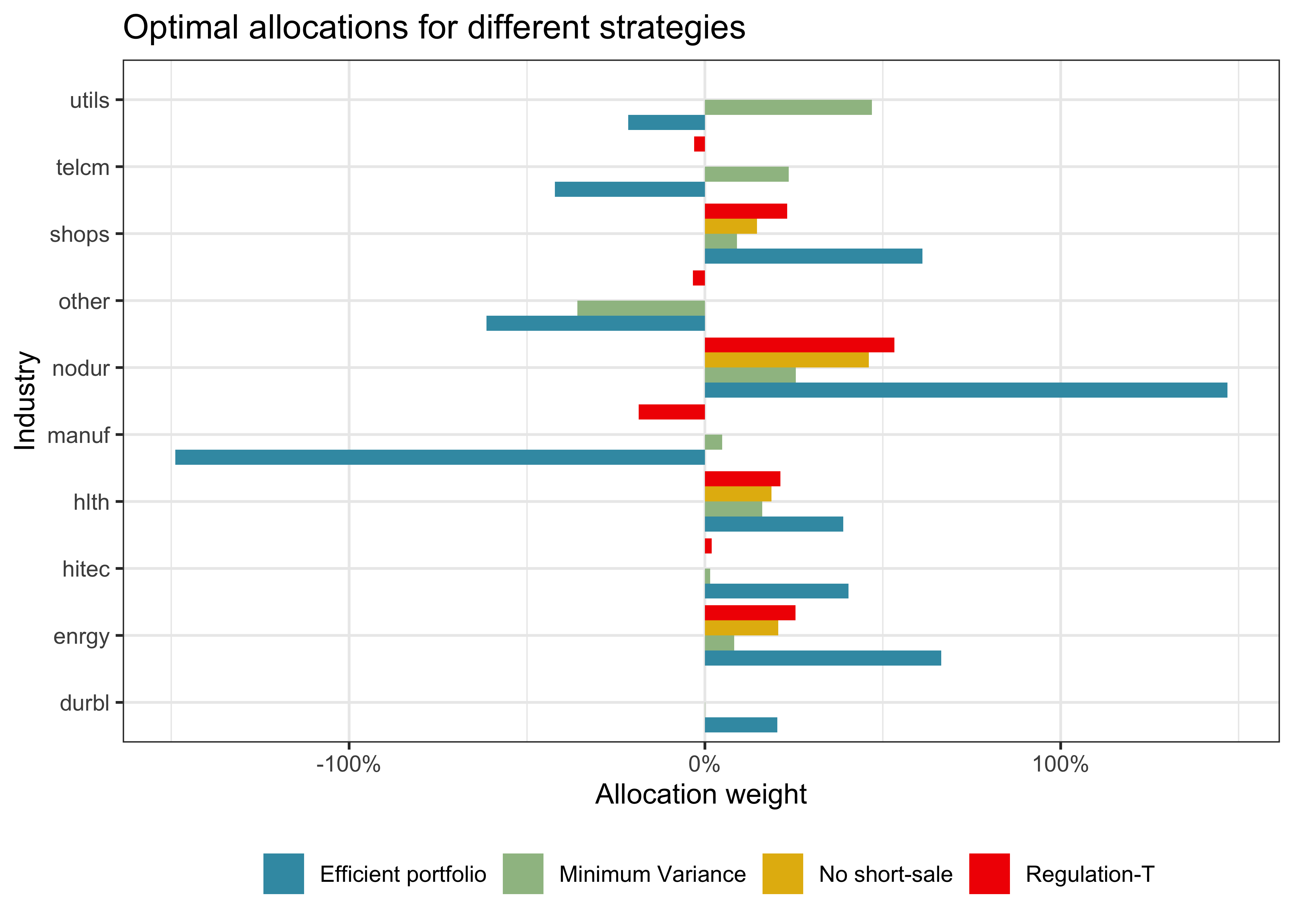

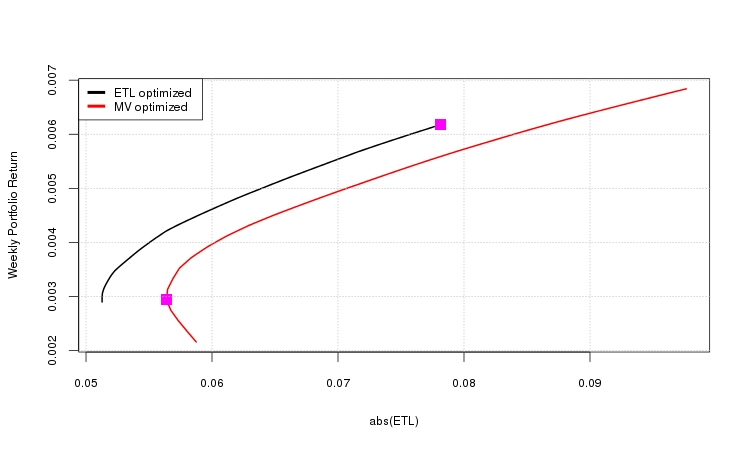

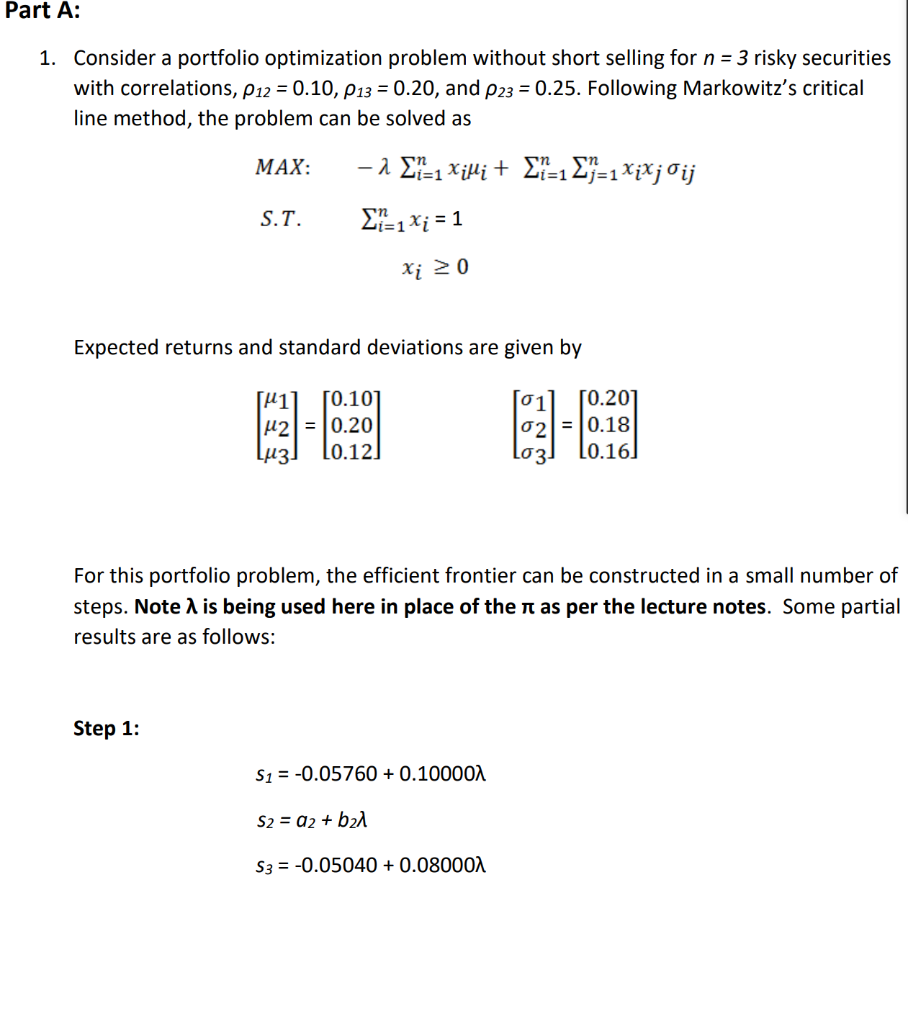

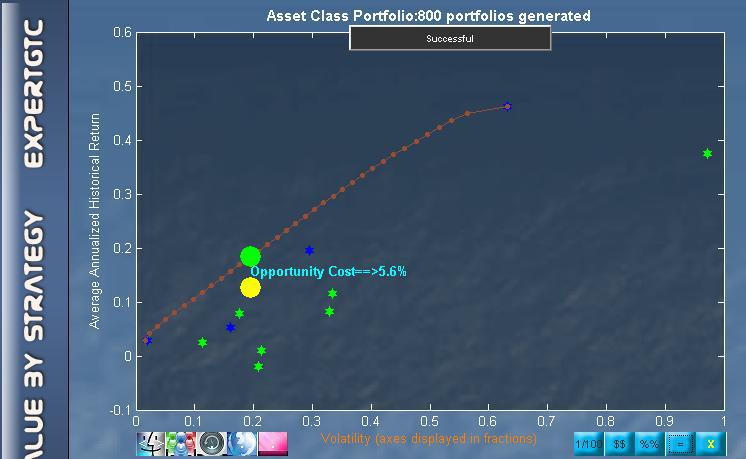

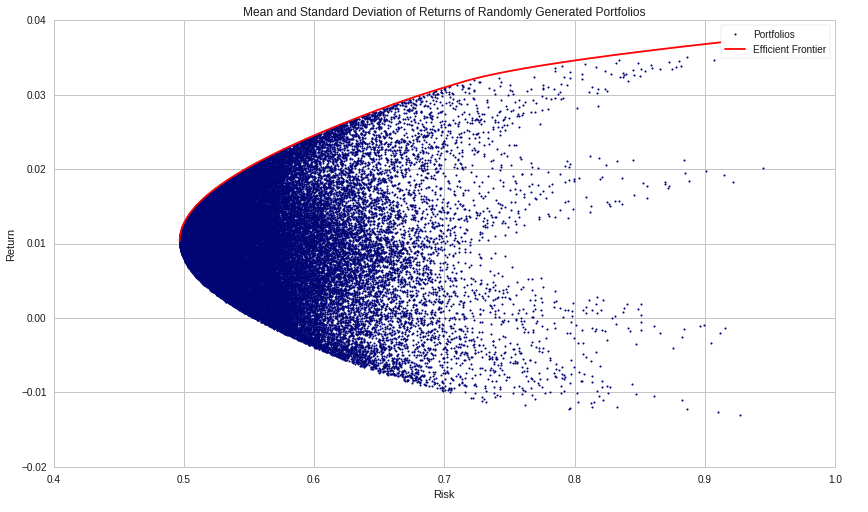

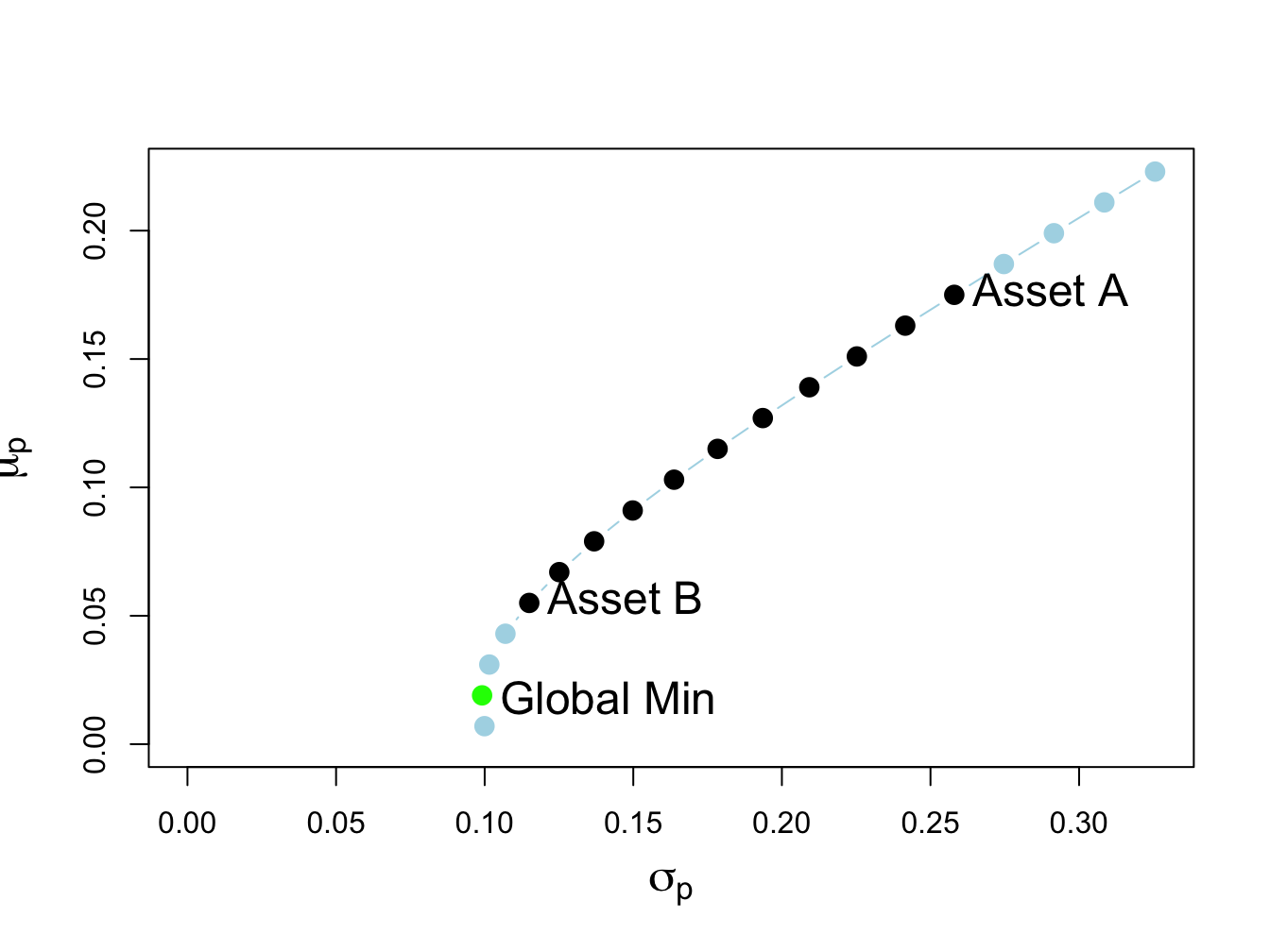

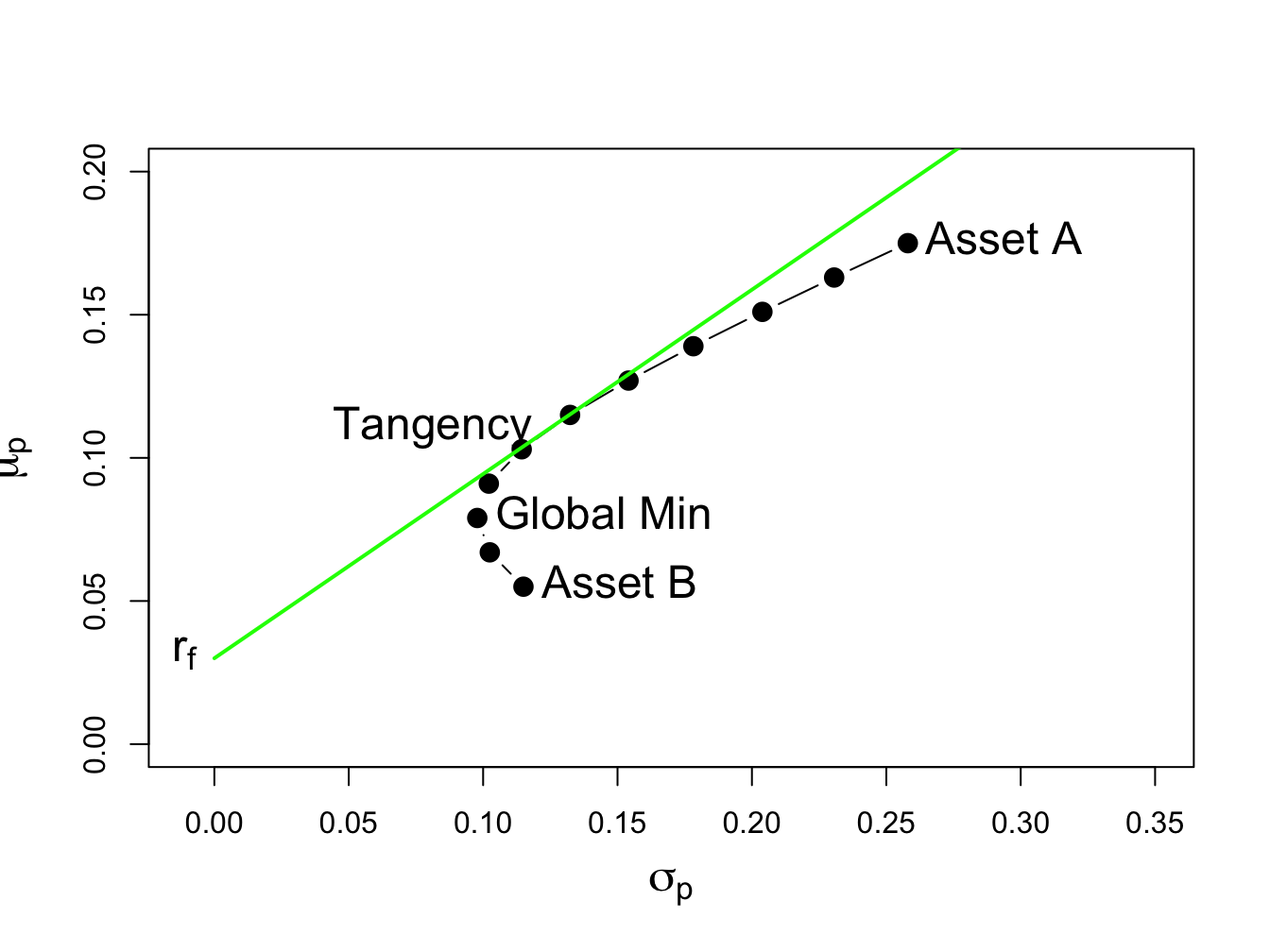

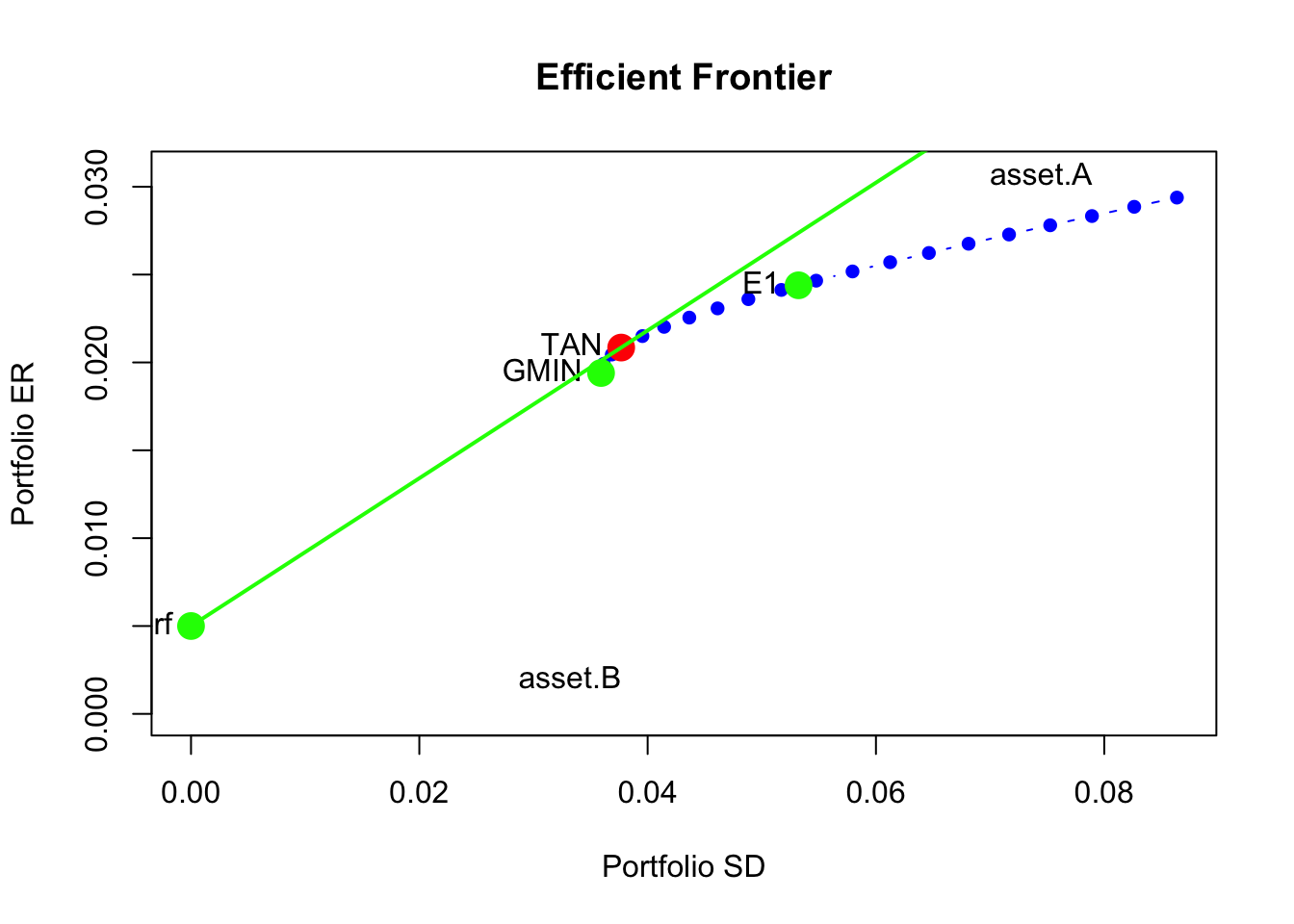

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

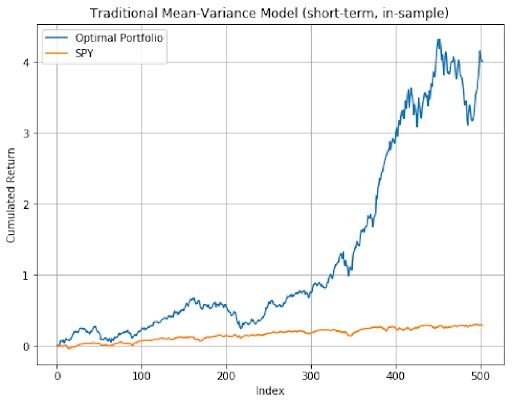

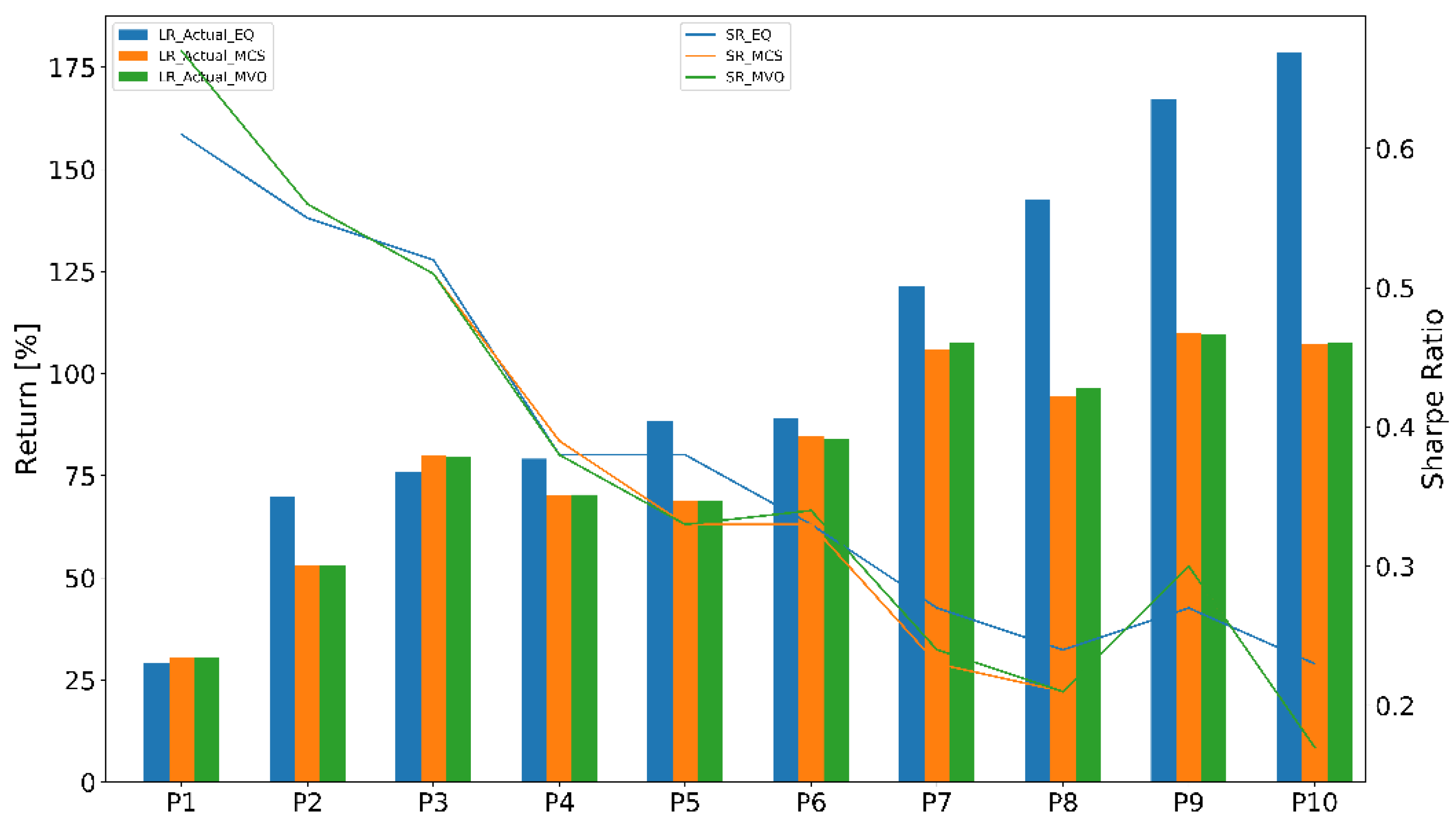

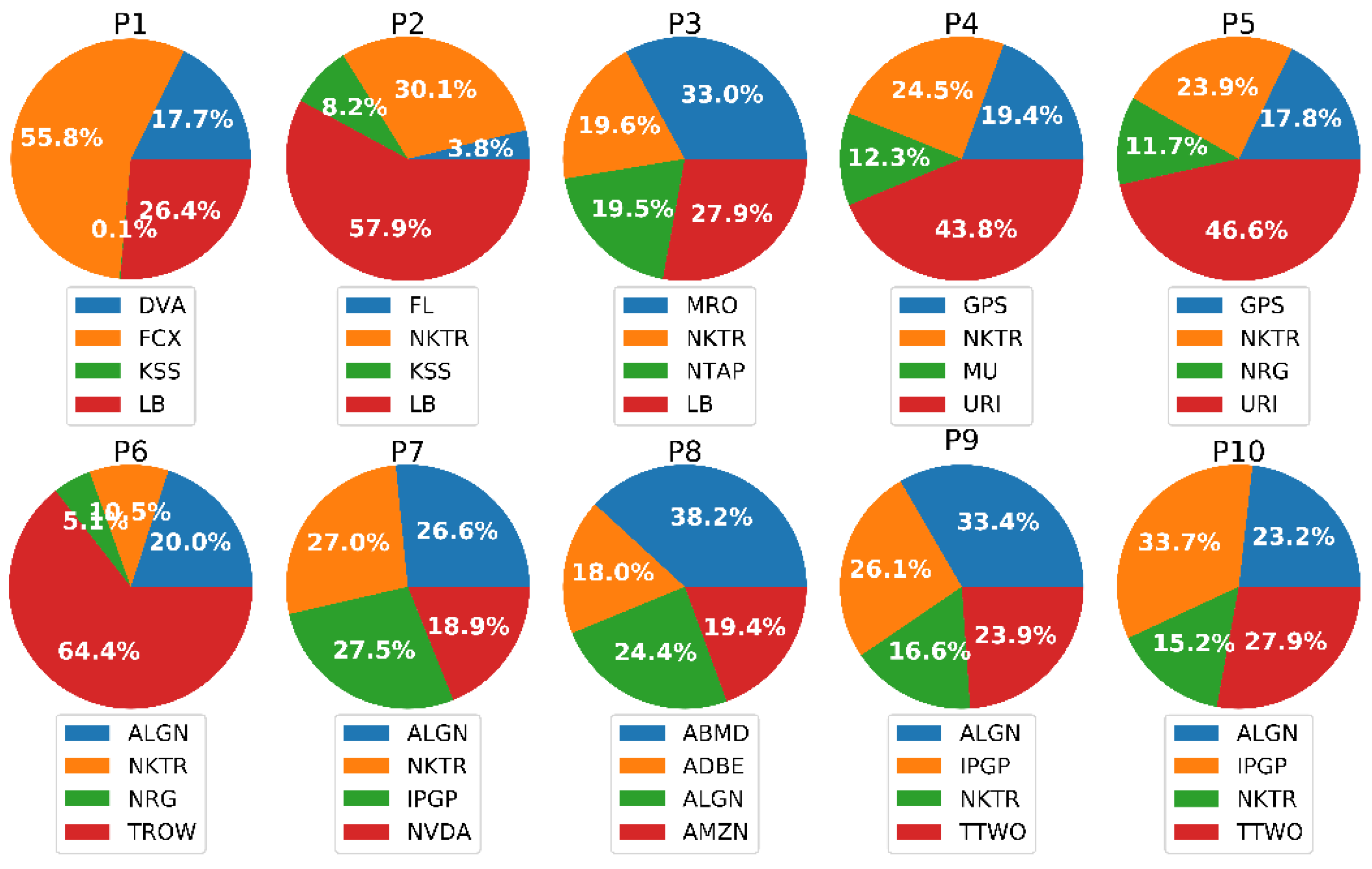

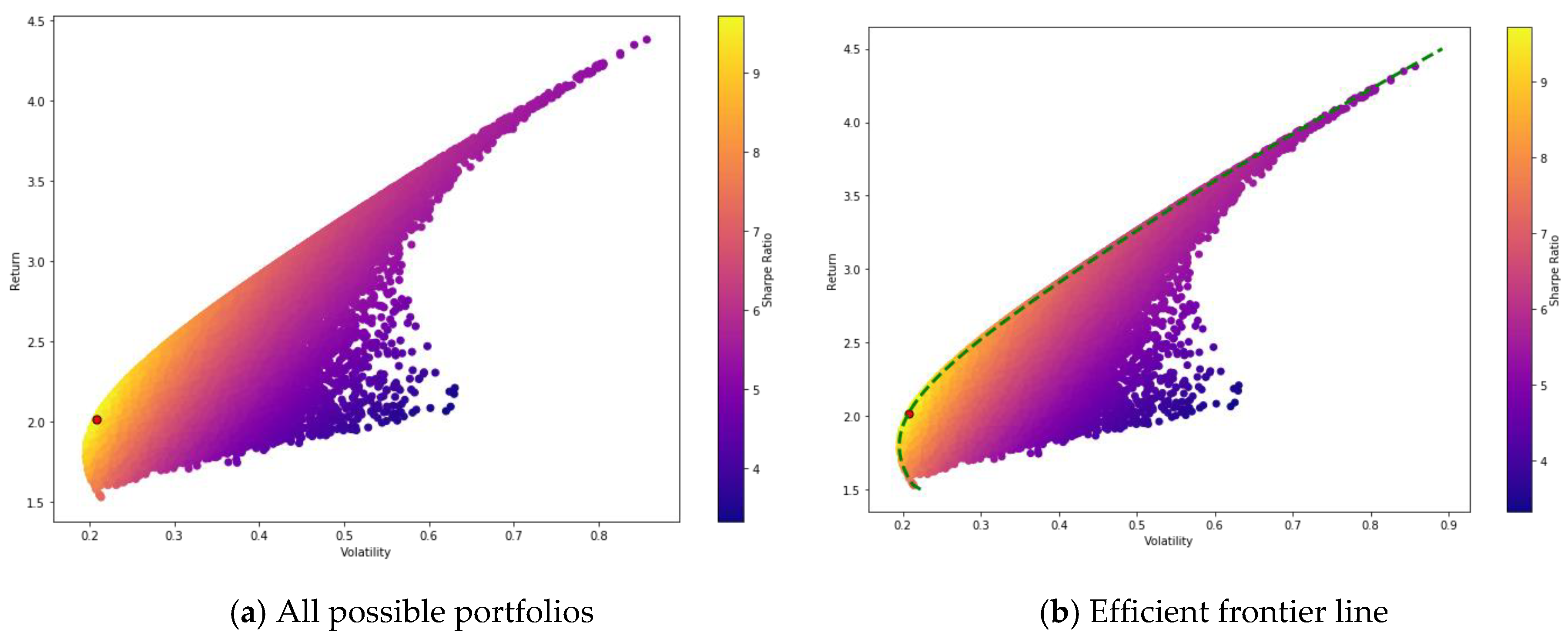

GitHub - georgemuriithi/investment-portfolio-optim: An investment portfolio of stocks is created using Long Short-Term Memory (LSTM) stock price prediction and optimized weights. The performance of this portfolio is better compared to an equally

Long/short portfolio optimization for the market crash of late 2018, Sharpe ratio 1.82, Return 35.4%

Applied Sciences | Free Full-Text | Portfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

The impact of regulation-based constraints on portfolio selection: The Spanish case | Humanities and Social Sciences Communications

Applied Sciences | Free Full-Text | Portfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading